Whereas the home currency equivalent value of the foreign currency bank account increase by SGD0.02 and the home currency bank account has reduced to SGD20,137.48 (SGD20,137.50 – SGD0.02), which is the actual amount received in the home currency bank. Pass a home currency adjustment journal to debit SGD0.02 to the foreign currency bank and credit SGD0.02 from the home currency bank.Ī home currency adjustment journal is a journal to adjust the home currency value therefore, the foreign currency balance of the foreign currency bank account remains unchanged. We will learn which accounts will be affected most by multicurrency transactions, these accounts being cash account types, accounts receivable account types, and accounts payable.

QUICKBOOKS COMPANY SETTINGS MULTICURRENCY HOW TO

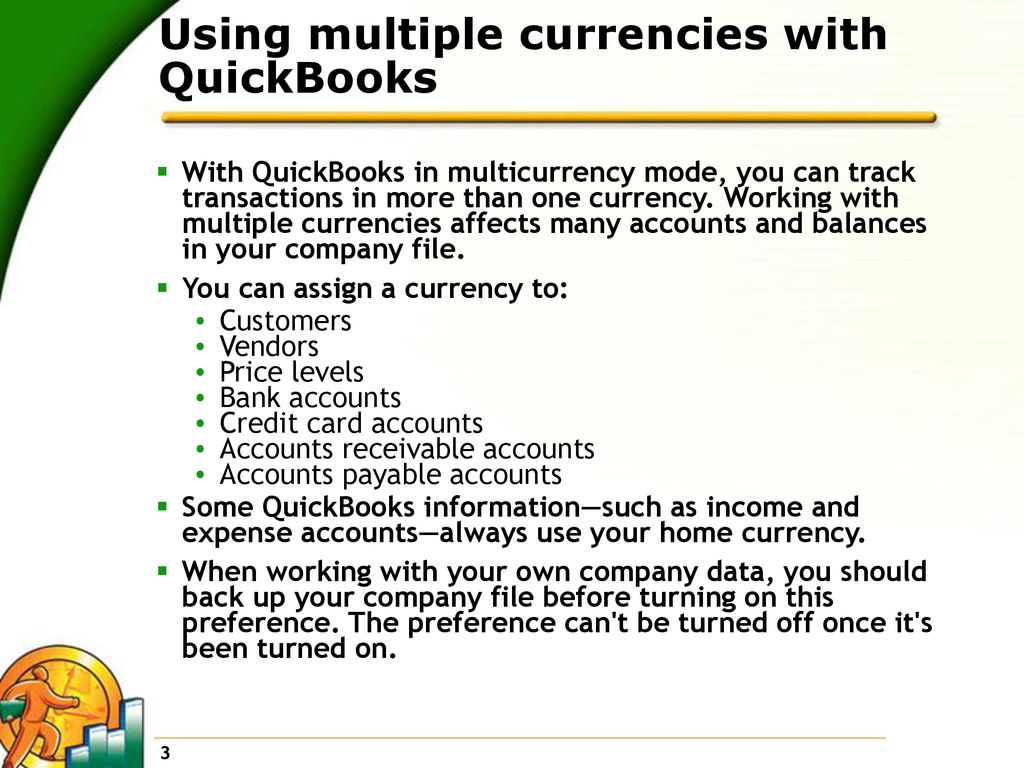

We will learn how to turn multicurrency on in both QuickBooks Online and QuickBooks Desktop. Since the amount recorded in QuickBooks (SGD20,137.50) is different from the actual amount received in the bank (SGD20,137.48), a home currency adjustment journal is needed to adjust between the home currency value of the foreign currency bank account and the amount recorded in the home currency bank account. QuickBooks will then automate the process making it more efficient. The nearest exchange rate you can use for this transfer is 1USD:1.34250SGD hence, SGD20,137.50 is debited to the QuickBooks home currency bank account. Select the I understand I can’t undo Multicurrency checkbox.

Scroll down to Currency and click the pencil icon (Edit).

QuickBooks 2015 allows up to 5 decimal places in the exchange rate between the US dollar and the Singapore dollar. Click the Gear icon and select Account and Settings. Software: Intuit QuickBooks 2015 accounting softwareĭue to the differences in exchange rate, the amount received in the home currency bank, which has transferred from a foreign currency bank account, could be different from the amount recorded in the QuickBooks accounting software.Īssuming you transferred USD15,000 from a US dollar bank account, which is a foreign currency account, to a home currency bank account SGD20,137.48 is received in the home currency bank account.

0 kommentar(er)

0 kommentar(er)